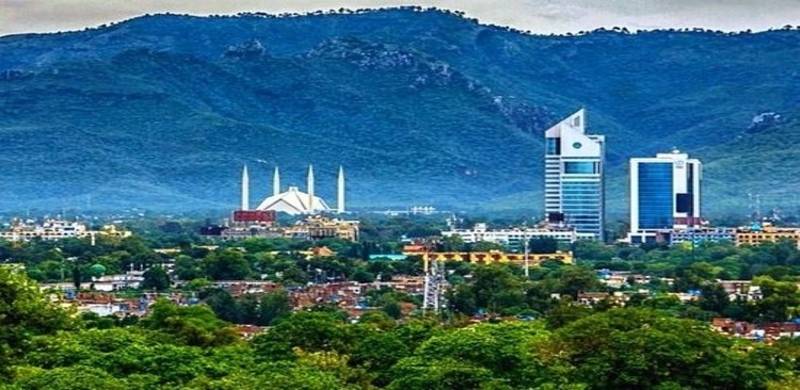

Islamabad

The Metropolitan Corporation Islamabad (MCI) has made a 30 percent increase in property taxes in the federal capital.

A notification issued by the MCI stated that in its last meeting, it had approved the revision of property taxes in Islamabad Capital Territory (ICT) in consultation with the Cabinet division.

The hike in property taxes has been categorized according to different sectors of Islamabad and those who failed to submit the additional property taxes till the end of September would have to submit a two percent fine to the MCI.

According to the new tax rules as delineated by the notification, the residents of the E and F sectors will have to pay six rupees per square yard along with eight rupees per square yard of covered area.

Moreover, the G and I sectors will pay additional taxes of four and six rupees per square yard and per square yard of covered area.

Taxes for E and F markaz are 10 rupees per square yard along with 16 rupees per square yard of the covered areas.

The new taxes for G and I Markaz are seven rupees per square yard and 11 rupees per square yard of covered area.

Moreover, the new tax rates for hotels and motels are now 12 and 18 rupees per square yard and per square yard of the covered area. Agricultural farms will have to pay two rupees per square yard and six rupees per square yard of covered area.

The property taxes for petrol pumps and CNG stations are now 90 rupees per square yard. Furthermore, the industrial buildings and public and private clubs will have to pay five rupees per square yard and nine rupees per square yard of the covered area.

The Metropolitan Corporation Islamabad (MCI) has made a 30 percent increase in property taxes in the federal capital.

A notification issued by the MCI stated that in its last meeting, it had approved the revision of property taxes in Islamabad Capital Territory (ICT) in consultation with the Cabinet division.

The notification added that the annual value of buildings and lands for the purpose of this levy shall be determined by an admixture of plot area and the covered area of the buildings.

The hike in property taxes has been categorized according to different sectors of Islamabad and those who failed to submit the additional property taxes till the end of September would have to submit a two percent fine to the MCI.

According to the new tax rules as delineated by the notification, the residents of the E and F sectors will have to pay six rupees per square yard along with eight rupees per square yard of covered area.

Moreover, the G and I sectors will pay additional taxes of four and six rupees per square yard and per square yard of covered area.

Property taxes imposed in the commercial Blue Area are 12 rupees per square yard as well as 18 rupees per square yard of the covered area.

Taxes for E and F markaz are 10 rupees per square yard along with 16 rupees per square yard of the covered areas.

The new taxes for G and I Markaz are seven rupees per square yard and 11 rupees per square yard of covered area.

The private hospitals in the capital will have new taxes as 7 and 11 rupees per square yard and per square yard of covered area respectively.

Moreover, the new tax rates for hotels and motels are now 12 and 18 rupees per square yard and per square yard of the covered area. Agricultural farms will have to pay two rupees per square yard and six rupees per square yard of covered area.

The property taxes for petrol pumps and CNG stations are now 90 rupees per square yard. Furthermore, the industrial buildings and public and private clubs will have to pay five rupees per square yard and nine rupees per square yard of the covered area.