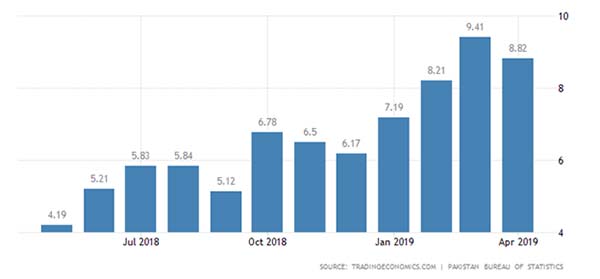

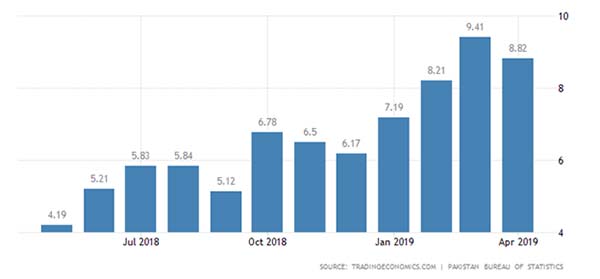

Inflation is one of the most pressing issues for Pakistan. According to Trading Economics data, Pakistan’s inflation in March 2019 rose to its highest in five years (9.41%) since November 2013, when inflation rate was recorded at 10.90%. The issue is exacerbated by lower confidence on Pakistan’s currency which has lost over a quarter of its value over the past year. Due to unsteady and unpredictable changes in price level and dollar-rupee exchange, the uncertainty abounds. The investor confidence is falling and thus fears of capital flight are rising. This was also noted in the recent cabinet meeting by PM Khan who hinted at taking preventive measures against capital flight.

Last week, a delegation of businessmen met with Finance Minister to share concerns on current macroeconomic situation and ‘markets’ distressed sentiments.’ In short, the current situation paints a very bleak picture of stagnated economy due to government’s lack of control and failure in ‘managing’ both the increase in inflation and exchange rate fluctuations.

Let The Inflation Stats Speak For Themselves

When comparing with neighbouring countries, one finds that inflation in Pakistan is the worst. As per the most recent estimates available with Trading Economics, the inflation rate in Pakistan was 8.82 percent year-on-year in April 2019. In the neighbouring countries, Bangladesh showed 5.55%, Sri Lanka 4.50%, Nepal 4.20%, India 2.92%, Indonesia 2.83% and China observed 2.50% rate of inflation.

One of the most common measures of inflation, the Consumer Price Index or CPI, measures changes in the prices paid by consumers for ‘a basket of goods and services’. Pakistan Bureau of Statistics collects the retail prices and computes the Consumer Price Index (CPI) for a basket of 487 items collected from 40 cities and 76 markets. As per its recent press release, the average inflation rate, or the Consumer Price Index of July-April, 2018-19 increased by 7.00% over July-April, 2017-18.

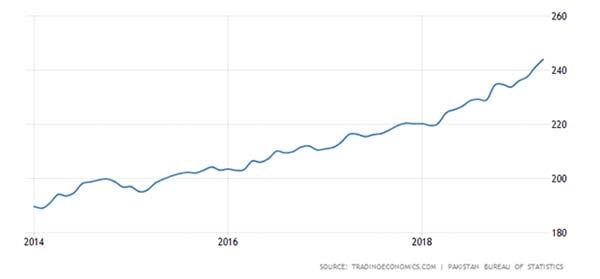

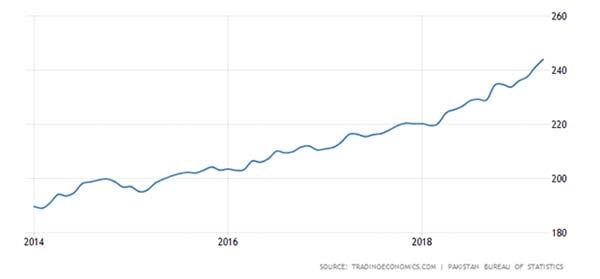

According to Trading Economics data, CPI in Pakistan increased to 244.03 Index Points, all time high in April from 240.99 Index Points in March of 2019 by 1.26% (base year 2007/08). Unfortunately, the essential items in the average household’s basket underwent sharper rise. As the increase in general price level is ascribed to rising fuel prices, the direct relation between fuel and general inflation is expected to play out well as the former has substantial indirect impact on other items.

It is also evident from the yearly data from 2014-2015 when the country witnessed record low levels of inflation; Pakistan inflation rate eased to 3.96 percent in November of 2014, 11-year low, and further slowed down to 3.24 percent in February of 2015. The falling prices were a direct result of global decline in oil prices.

Inflation-One Of The Most Pressing Concerns For People And Economy

With new oil prices, the cost of raw materials has been increased. While the producers are gravely concerned, what is even more perplexing is that the increase in costs would be borne by the consumers over time. This is supported by the economic research in a technical way: if consumers’ demand for a particular basket of items, like food, is relatively more inelastic, they would bear most of the burden in taxes and hikes, in contrast to producers.

This does not necessarily mean that businesses are immune to inflation. As consumer demand falls, businesses are affected too because their sales and profits decrease. Consequently, real income growth is adversely affected.

According to a Gilani Research Foundation Survey carried out by Gallup and Gilani Pakistan (from April 21 to April 30), 1 in 3 Pakistanis believe inflation is the most pressing issue facing the country at the moment. A nationally representative sample of men and women from across the four provinces was asked, “What, in your opinion, is the most pressing issue Pakistan is facing right now?” In response, 33% said inflation, 19% said unemployment, while only 14% said corruption.

War on corruption has been the key to PTI government’s political rhetoric – two birds with one stone; the government has been ranting over corruption, as a politically expedient move to keep pressure on opposition and divert public attention from the inflation bomb and ‘sinister details’ of the IMF deal.

Meanwhile, the poor are suffering in the fires of inflation, at least in part due to the negligence and distractedness of the rulers. Dawn newspaper wrote in its editorial last week, “No word has come of a package of support for the utility stores, for example, where at least the most desperate and vulnerable can find a little refuge from the price hikes that threaten to engulf them.”

Part of the price hike may well be a large increase in fuel prices only days before Ramazan, but maybe equally to blame is the hoarding and profiteering on the part of unscrupulous traders as they see the onset of a demand spiral coming their way.

Every year, just before Ramazan, essential food commodities disappear from the market, thanks to the mutual connivance of profiteers and their disregard of price lists set by the government. Moreover, the government has failed to enforce the price lists in Ramazan bazaars where consumers are being charged well above the listed prices.

The IMF Deal And Inflation – An Unholy Nexus

One of the conditions in IMF deal is the currency devaluation. The programme would entail raising prices in some areas in order to recover the costs, highlighted Finance Minister. As reported in news agencies, the Pakistan Stock Exchange (PSX) experienced a bloodbath that very day (May 13) with the benchmark KSE-100 Shares Index shedding 937 points — a loss of more than 2.7 per cent — during intra-day trading. Analysts held the tough conditions attached with the IMF bailout package responsible for bearish rule at the bourse.

The opposition parties raised questions and unanimously opposed the deal. PML-N mockingly termed the so called bail-out package of USD 6 billion a sell-out. Opposition members protested that the agreement will result in a “tsunami of inflation”, “New taxes will be imposed” and that the government was “dropping an inflation bomb on the underprivileged masses of the country”.

On the other hand, the incumbent government has been blaming the previous governments for the tough choices it is making ‘to rectify the wrongs of decades’; so it has been repeatedly asserting to escape the responsibility of its actions. For how long the PTI government would continue this political strategy which is characterised by externalising the undesirable actions aimed at retaining public trust and support from the public while provoking public hatred against previous parties in power?

The Future Outlook

As reported in national English newspapers over the last week, the market players are saying that the impact of the recent fuel price hike has yet to be factored in, which means further increases should be expected in food prices. Analysts expect inflation to reach close to double digits.

Inflation rate in Pakistan averaged 7.76 percent from 1957 until 2019, reaching an all-time high of 37.81 percent in December of 1973 and a record low of -10.32 percent in February of 1959. Asian Development Bank forecasts inflation to remain highest in Pakistan in 2019, 7.5%, as compared to other countries in South Asia; in Bangladesh 5.5%, Nepal 4.4%, India 4.3% and Sri Lanka 3.5%. The GDP growth forecasts are not good news either; projected to be 3.9% in 2019 while falling to 3.6% in 2020, as per ADB forecasts.

Historically, the Pakistani rupee reached an all-time high of 151 this month. Despite 32 percent depreciation in Pakistani rupee over the last 12 months, in real terms it depreciated by 13 percent based on Real Effective Exchange Rate (REER), market experts estimate. Many market experts believe that Pakistani rupee is still overvalued by 4 percent based on REER and expect it to more closely track its fair value. They expected US dollar to cross PKR 150 by the end of December-2019. Interestingly, on May 18, this prediction came true way earlier, when dollar hit the 150-rupee mark.

Recently, PM Imran Khan urged the nation to give qurbaani (sacrifice). The government could at least begin with removing uncertainties by presenting a coherent strategic planning for bad times. Most importantly, the government should be positively predisposed towards its own people and build public confidence and trust by sharing the agreed upon conditions of the IMF deal. It would remove uncertainties which are distressing the markets.

Last week, a delegation of businessmen met with Finance Minister to share concerns on current macroeconomic situation and ‘markets’ distressed sentiments.’ In short, the current situation paints a very bleak picture of stagnated economy due to government’s lack of control and failure in ‘managing’ both the increase in inflation and exchange rate fluctuations.

Let The Inflation Stats Speak For Themselves

When comparing with neighbouring countries, one finds that inflation in Pakistan is the worst. As per the most recent estimates available with Trading Economics, the inflation rate in Pakistan was 8.82 percent year-on-year in April 2019. In the neighbouring countries, Bangladesh showed 5.55%, Sri Lanka 4.50%, Nepal 4.20%, India 2.92%, Indonesia 2.83% and China observed 2.50% rate of inflation.

One of the most common measures of inflation, the Consumer Price Index or CPI, measures changes in the prices paid by consumers for ‘a basket of goods and services’. Pakistan Bureau of Statistics collects the retail prices and computes the Consumer Price Index (CPI) for a basket of 487 items collected from 40 cities and 76 markets. As per its recent press release, the average inflation rate, or the Consumer Price Index of July-April, 2018-19 increased by 7.00% over July-April, 2017-18.

According to Trading Economics data, CPI in Pakistan increased to 244.03 Index Points, all time high in April from 240.99 Index Points in March of 2019 by 1.26% (base year 2007/08). Unfortunately, the essential items in the average household’s basket underwent sharper rise. As the increase in general price level is ascribed to rising fuel prices, the direct relation between fuel and general inflation is expected to play out well as the former has substantial indirect impact on other items.

It is also evident from the yearly data from 2014-2015 when the country witnessed record low levels of inflation; Pakistan inflation rate eased to 3.96 percent in November of 2014, 11-year low, and further slowed down to 3.24 percent in February of 2015. The falling prices were a direct result of global decline in oil prices.

Pakistan Consumer Price Index 2014-2019

Inflation-One Of The Most Pressing Concerns For People And Economy

With new oil prices, the cost of raw materials has been increased. While the producers are gravely concerned, what is even more perplexing is that the increase in costs would be borne by the consumers over time. This is supported by the economic research in a technical way: if consumers’ demand for a particular basket of items, like food, is relatively more inelastic, they would bear most of the burden in taxes and hikes, in contrast to producers.

This does not necessarily mean that businesses are immune to inflation. As consumer demand falls, businesses are affected too because their sales and profits decrease. Consequently, real income growth is adversely affected.

According to a Gilani Research Foundation Survey carried out by Gallup and Gilani Pakistan (from April 21 to April 30), 1 in 3 Pakistanis believe inflation is the most pressing issue facing the country at the moment. A nationally representative sample of men and women from across the four provinces was asked, “What, in your opinion, is the most pressing issue Pakistan is facing right now?” In response, 33% said inflation, 19% said unemployment, while only 14% said corruption.

War on corruption has been the key to PTI government’s political rhetoric – two birds with one stone; the government has been ranting over corruption, as a politically expedient move to keep pressure on opposition and divert public attention from the inflation bomb and ‘sinister details’ of the IMF deal.

Meanwhile, the poor are suffering in the fires of inflation, at least in part due to the negligence and distractedness of the rulers. Dawn newspaper wrote in its editorial last week, “No word has come of a package of support for the utility stores, for example, where at least the most desperate and vulnerable can find a little refuge from the price hikes that threaten to engulf them.”

Part of the price hike may well be a large increase in fuel prices only days before Ramazan, but maybe equally to blame is the hoarding and profiteering on the part of unscrupulous traders as they see the onset of a demand spiral coming their way.

Every year, just before Ramazan, essential food commodities disappear from the market, thanks to the mutual connivance of profiteers and their disregard of price lists set by the government. Moreover, the government has failed to enforce the price lists in Ramazan bazaars where consumers are being charged well above the listed prices.

The IMF Deal And Inflation – An Unholy Nexus

One of the conditions in IMF deal is the currency devaluation. The programme would entail raising prices in some areas in order to recover the costs, highlighted Finance Minister. As reported in news agencies, the Pakistan Stock Exchange (PSX) experienced a bloodbath that very day (May 13) with the benchmark KSE-100 Shares Index shedding 937 points — a loss of more than 2.7 per cent — during intra-day trading. Analysts held the tough conditions attached with the IMF bailout package responsible for bearish rule at the bourse.

The opposition parties raised questions and unanimously opposed the deal. PML-N mockingly termed the so called bail-out package of USD 6 billion a sell-out. Opposition members protested that the agreement will result in a “tsunami of inflation”, “New taxes will be imposed” and that the government was “dropping an inflation bomb on the underprivileged masses of the country”.

On the other hand, the incumbent government has been blaming the previous governments for the tough choices it is making ‘to rectify the wrongs of decades’; so it has been repeatedly asserting to escape the responsibility of its actions. For how long the PTI government would continue this political strategy which is characterised by externalising the undesirable actions aimed at retaining public trust and support from the public while provoking public hatred against previous parties in power?

The Future Outlook

As reported in national English newspapers over the last week, the market players are saying that the impact of the recent fuel price hike has yet to be factored in, which means further increases should be expected in food prices. Analysts expect inflation to reach close to double digits.

Inflation rate in Pakistan averaged 7.76 percent from 1957 until 2019, reaching an all-time high of 37.81 percent in December of 1973 and a record low of -10.32 percent in February of 1959. Asian Development Bank forecasts inflation to remain highest in Pakistan in 2019, 7.5%, as compared to other countries in South Asia; in Bangladesh 5.5%, Nepal 4.4%, India 4.3% and Sri Lanka 3.5%. The GDP growth forecasts are not good news either; projected to be 3.9% in 2019 while falling to 3.6% in 2020, as per ADB forecasts.

Historically, the Pakistani rupee reached an all-time high of 151 this month. Despite 32 percent depreciation in Pakistani rupee over the last 12 months, in real terms it depreciated by 13 percent based on Real Effective Exchange Rate (REER), market experts estimate. Many market experts believe that Pakistani rupee is still overvalued by 4 percent based on REER and expect it to more closely track its fair value. They expected US dollar to cross PKR 150 by the end of December-2019. Interestingly, on May 18, this prediction came true way earlier, when dollar hit the 150-rupee mark.

Recently, PM Imran Khan urged the nation to give qurbaani (sacrifice). The government could at least begin with removing uncertainties by presenting a coherent strategic planning for bad times. Most importantly, the government should be positively predisposed towards its own people and build public confidence and trust by sharing the agreed upon conditions of the IMF deal. It would remove uncertainties which are distressing the markets.