Kashif Khan writes about the current economic situation in Pakistan and the economic outlook, focusing specifically on food inflation, exports and imports, and the gross domestic product. He also provides solutions to the bleak economic future.

There can be no economy where there is no efficiency – Benjamin Disraeli

Latest economic data available on the websites of Pakistan Bureau of Statistics and State Bank of Pakistan is sadly not different from the previous month or months. The upward trend of inflation continues and cost of living is becoming unbearable for many households in Pakistan. Interestingly Pakistan Bureau of Statistics has changed the base year for price statistics from 2007-08 to 2015-16. The Governing Council directed that the Consumer Price Index (CPI) for new base year (2015-16) will be published along with CPI for old base year 2007-08 for some time. Reasons behind this change are not given on PBS’s website. This change in methodology has reduced the inflation rate.

Change of base year is a well-known and established technique to capture the economic information accurately. In some cases, state institutes are accused of changing this under government influence to show better performance; recent example is India where change of base year caused uproar in Lok Sabha. However, we do have comparisons available based on both old and new base year on the website of PBS. Below is the snapshot of this comparison.

As you can see from the above chart the average rate of inflation is reduced by 1.54% (10.98% vs 9.44%) if we take 2015-16 as base year compared to base year 2007-08. The point worth noting is that the State Bank of Pakistan is still using the old base year i.e. 2007-08. In my analysis below I am also going to use base year 2007-08 to keep the consistency of data. According to the available data, inflation is still growing double-digit compared to the previous year. The upward trend even continues from one month to another month. Inflation rate for August 2019 is 1.29% higher compared to July 2019. SPI which includes food and daily life necessities is increased by 14.96% in August, as compared to 3.26% in 2018 & -0.09% in 2017.

Below is the inflation table which shows the astonishing growth of SPI every month. From May 2019 onward SPI is rising at the rate of above 10% per month. In the past six months, inflation for daily life necessities has increased by 70%.

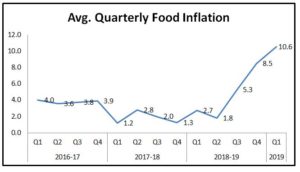

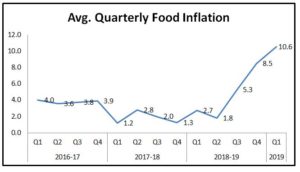

The graph below shows average quarterly food inflation from FY 2016-17 to Q1 2019. In the past three years, average food inflation remained below 3%. The average for FY 2019 -20 so far is almost 11%.

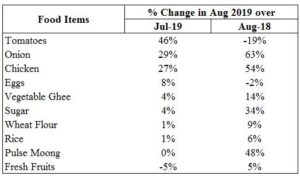

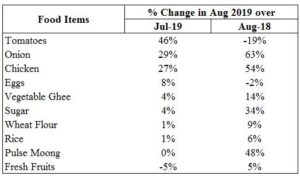

Some of the changes in food prices last month are shown in the table below.

The rise of food inflation is quite alarming when viewed with the prevalence of undernourishment and stunting in general population and children. Following data by Asian Development Bank indicates the gravity of situation.

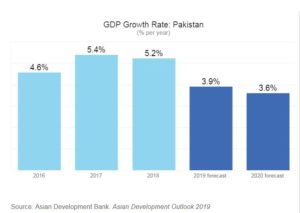

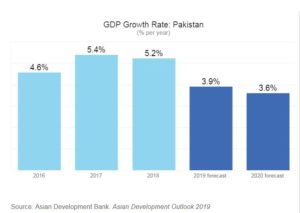

Macro economic indicators are also indicating that economy is going to shrink even further. Our GDP is forecasted to drop 1.3% this year compared to 2018. Next year, the forecast is showing a further decline of 0.3% compared to current year.

Pakistan’s total debt and liabilities now represent staggering 104.3% of GDP. Year on year growth in debt is 34.6%.

In the midst of troublesome numbers, we also have some green shoots visible in the form of comparative growth in exports. Compared to June 2019, exports witnessed handsome double digit growth of 24% in the month of July. However, historically exports have always been one step forward and two steps backwards. Exports for the month of June were 22% down from the month of May 2019. Favourable impact of currency devaluation on exports is yet to be seen. Table below from SBP’s website further highlights the trend of exports.

In the month of July, exports increased by 24% whereas imports marginally increased by 2% as shown in the summary below, resulting in a positive impact of $349 million on balance of payments.

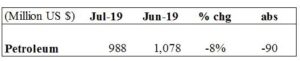

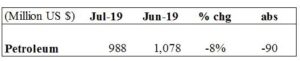

However, the underlying increase in imports is more than 2% due to the fact that from 1st July, we have the facility of deferred payment relief of $275m per month for oil imports agreed with Saudi Arabia. Import of petroleum products were 8% below as shown in the table below. Latest developments in Middle East may have an adverse impact on our balance of payments in coming months.

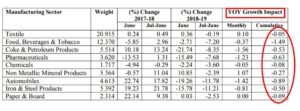

Large Scale Manufacturing Industry (LSMI) witnessed another month of decline in output. LSMI output decreased by 5.05% in June 2019.

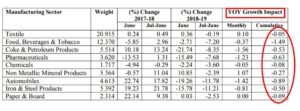

Following sectors are showing decline in LSMI. Textile is the most important sector which also happens to be the flag bearer of our exports.

It is quite evident from the above data that we are facing an economic stalemate. Those who are at the helm of affairs must act swiftly to take corrective measures before its too late. The first step would be to create a conducive environment for economic growth. Some low hanging fruits in such direction would be to legislate in parliament to control over zealous NAB, simplify revenue collection i.e. address the issue of sales tax refunds and complicated record keeping. Last but by no means the least, ensure political stability. The sooner we do this the better it will be for our economy and our country.

It is quite evident from the above data that we are facing an economic stalemate. Those who are at the helm of affairs must act swiftly to take corrective measures before its too late. The first step would be to create a conducive environment for economic growth. Some low hanging fruits in such direction would be to legislate in parliament to control over zealous NAB, simplify revenue collection i.e. address the issue of sales tax refunds and complicated record keeping. Last but by no means the least, ensure political stability. The sooner we do this the better it will be for our economy and our country.

There can be no economy where there is no efficiency – Benjamin Disraeli

Latest economic data available on the websites of Pakistan Bureau of Statistics and State Bank of Pakistan is sadly not different from the previous month or months. The upward trend of inflation continues and cost of living is becoming unbearable for many households in Pakistan. Interestingly Pakistan Bureau of Statistics has changed the base year for price statistics from 2007-08 to 2015-16. The Governing Council directed that the Consumer Price Index (CPI) for new base year (2015-16) will be published along with CPI for old base year 2007-08 for some time. Reasons behind this change are not given on PBS’s website. This change in methodology has reduced the inflation rate.

Change of base year is a well-known and established technique to capture the economic information accurately. In some cases, state institutes are accused of changing this under government influence to show better performance; recent example is India where change of base year caused uproar in Lok Sabha. However, we do have comparisons available based on both old and new base year on the website of PBS. Below is the snapshot of this comparison.

As you can see from the above chart the average rate of inflation is reduced by 1.54% (10.98% vs 9.44%) if we take 2015-16 as base year compared to base year 2007-08. The point worth noting is that the State Bank of Pakistan is still using the old base year i.e. 2007-08. In my analysis below I am also going to use base year 2007-08 to keep the consistency of data. According to the available data, inflation is still growing double-digit compared to the previous year. The upward trend even continues from one month to another month. Inflation rate for August 2019 is 1.29% higher compared to July 2019. SPI which includes food and daily life necessities is increased by 14.96% in August, as compared to 3.26% in 2018 & -0.09% in 2017.

Below is the inflation table which shows the astonishing growth of SPI every month. From May 2019 onward SPI is rising at the rate of above 10% per month. In the past six months, inflation for daily life necessities has increased by 70%.

The graph below shows average quarterly food inflation from FY 2016-17 to Q1 2019. In the past three years, average food inflation remained below 3%. The average for FY 2019 -20 so far is almost 11%.

Some of the changes in food prices last month are shown in the table below.

The rise of food inflation is quite alarming when viewed with the prevalence of undernourishment and stunting in general population and children. Following data by Asian Development Bank indicates the gravity of situation.

Macro economic indicators are also indicating that economy is going to shrink even further. Our GDP is forecasted to drop 1.3% this year compared to 2018. Next year, the forecast is showing a further decline of 0.3% compared to current year.

Pakistan’s total debt and liabilities now represent staggering 104.3% of GDP. Year on year growth in debt is 34.6%.

In the midst of troublesome numbers, we also have some green shoots visible in the form of comparative growth in exports. Compared to June 2019, exports witnessed handsome double digit growth of 24% in the month of July. However, historically exports have always been one step forward and two steps backwards. Exports for the month of June were 22% down from the month of May 2019. Favourable impact of currency devaluation on exports is yet to be seen. Table below from SBP’s website further highlights the trend of exports.

In the month of July, exports increased by 24% whereas imports marginally increased by 2% as shown in the summary below, resulting in a positive impact of $349 million on balance of payments.

However, the underlying increase in imports is more than 2% due to the fact that from 1st July, we have the facility of deferred payment relief of $275m per month for oil imports agreed with Saudi Arabia. Import of petroleum products were 8% below as shown in the table below. Latest developments in Middle East may have an adverse impact on our balance of payments in coming months.

Large Scale Manufacturing Industry (LSMI) witnessed another month of decline in output. LSMI output decreased by 5.05% in June 2019.

Following sectors are showing decline in LSMI. Textile is the most important sector which also happens to be the flag bearer of our exports.

It is quite evident from the above data that we are facing an economic stalemate. Those who are at the helm of affairs must act swiftly to take corrective measures before its too late. The first step would be to create a conducive environment for economic growth. Some low hanging fruits in such direction would be to legislate in parliament to control over zealous NAB, simplify revenue collection i.e. address the issue of sales tax refunds and complicated record keeping. Last but by no means the least, ensure political stability. The sooner we do this the better it will be for our economy and our country.

It is quite evident from the above data that we are facing an economic stalemate. Those who are at the helm of affairs must act swiftly to take corrective measures before its too late. The first step would be to create a conducive environment for economic growth. Some low hanging fruits in such direction would be to legislate in parliament to control over zealous NAB, simplify revenue collection i.e. address the issue of sales tax refunds and complicated record keeping. Last but by no means the least, ensure political stability. The sooner we do this the better it will be for our economy and our country.