Govt spending – the good, the bad

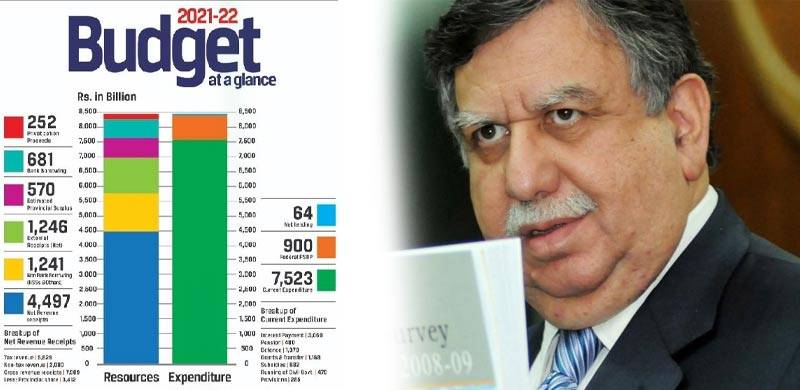

Since the government’s revenue and resource endowments remain unable to meet the country’s expenditures – which have risen by 15% to Rs 8.49 trillion in the financial year (FY) 2021-22 – it is attempting to fulfill the tidy outlay target of 4.8pc growth through (over) spending on public sector development ($900 billion). This demand driven growth will accompany inflation. So, will history be repeating itself or will the government realize how hard the task is, and thus decide to revamp or renew its ways?

Effect on Investment

Secondly, excessive government borrowing from local banks will crowd out private investment which has been largely ignored in the budget. Now, as well as in the past.

It is worth noting that the government is seeking job creation through its own social spending schemes – like Kamyab Jawaan Programme etc. Our investment to GDP ratio is one of the lowest in the region and investment, especially local-driven, is crucial for employment and thus economic growth.

Experts are of the opinion that Pakistan needs a growth rate of 6-8 percent per year to achieve full scale employment of our youth. Expert Raza Rumi also lays emphasis on the significance of local investment ventures.

The government wants us all to believe that public spending furthers economic growth and job creation, this kind of spending, even if it’s reckless is good for the economy and social well-being and fuels growth. I will not debunk this line of thought altogether despite the past year’s significant spending not yielding projected outcomes. Indeed, the government spending indicates a welfare model and there are examples of positive outcomes with that model. For instance the state came to the rescue through spending during the Great Depression of the 1930s, post World War 2 era and through the Marshall Plan when the US gave direct funding to European states for rebuilding and growing economically. Interestingly, aid was also given to third world countries like Pakistan – but they grew dependent on foreign aid.

Government spending-based growth

It is possible that increased spending and rise in tax could lead to an increase in GDP through a multiplier effect. If government spending causes the unemployed to gain jobs, they will have more income to spend, leading to a further increase in aggregate demand. However, with mostly social spending the government would run into fiscal and trade deficits and incur more loans if it did not adopt alternative revenue generation strategies.

Interventionist budget

What makes FY 2021-22 Budget of Pakistan distinct is that we have hardly seen anything comparable in the country’s recent history in terms of both width and coverage of people, and the depth of interventions. For instance, Musharraf era policies were based solely on growth and the ‘trickle down’ paradigm, PPP’s, and even PTI’s formerly presented budget all lag behind the current budget. Also, as looked at from the regional lens, one finds it “people-centric”, bottom-up, and “inclusive” growth, based on the principle of “sustainable” economic growth that targets the most vulnerable directly; without waiting on the growth effects to trickle down.

According to this humble author, this interventionist approach is perhaps the most needed and much appreciable roadmap for the future outlook of a state to become a welfare state with its citizens not paranoid or preoccupied with security.

This new budget is hence aimed at lending, supporting and thus lifting up impoverished groups and communities, including from the minority groups, out of their dual poverty-debt traps and other such vicious circles. This way, thereby, giving new life and hope and dreams to not just residents but overseas Pakistanis.

The main and highly advantageous key priority is to formalize the economy that has so far remained the biggest hurdle. It’s hard to track and document business activity so we never know what our actual capacity is or what has been our GDP.

I would highlight two key facts and findings which seem to have been key consideration for the incumbent government.

Trickle Down Effect -- Pakistan cannot wait

Free markets can work well and trickle down effect follows which can help achieve full scale employment and thus drive growth through job creation

But as stated by Shaukat Tareen, we – a country like Pakistan – need unabated economic growth for straight twenty years for trickle down effect to actualize. Not without some kind, or form of state intervention – direct through cash or indirect through food, clothing, shelter, housing, as being done by PTI government – note that recently World Bank also acknowledged the Pakistani government’s Ehsaas Programme as being among top of the world.

It is regrettable what had got deeply entrenched in Pakistan’s policy circles and business community during Ayub’s era – making of rich folks (remember 22 families) far more richer and believing that with time that money would eventually trickle down. Recall the Washington Consensus which later on down the years also endorsed this narrative of free market capitalism.

Pro-poor Budget

The pro-poor initiatives and social safety nets include the Ehsaas Programme’s “expansion” (Rs260bn). Further, no more taxes for salaried classes and 10 percent increase in salaries and pensions of government employees (which in a way sets the increment level in private sector). What it entails is that due to cut in taxes, or/and ‘increasing’ incomes – people will have more disposable incomes to spend – especially the poor/middle class – so such social spending schemes will greatly benefit the poor. Those impoverished could come out of poverty.

What is left after spending would be saved (or invested). So there could be two impacts: 1.Demand-push inflation caused by increased buying in the short term. And, 2. Increase in savings for both govt and private employees who have their wages increased.

Interestingly, the income could be brought under taxation if the govt adopts a carefully crafted strategy. Yes, the govt could still ‘receive’ tax money from disposable incomes through sale receipt system. One way to increase taxes as suggested by Tareen is a prize scheme to increase tax base. Thus, prizes amounting to Rs250 million will be distributed among receipt holders every month; a move that would help in documentation of the economy and add about 312,000 potential taxpayers. The government expects to collect Rs100 to Rs150 bn additional revenue through the PoS system (as Points of Sale will be increased from 10,000 to 60,000).

Revenues and tax widening go together

Tax collection target set at Rs5,829bn is both highly challenging and aggressive; experts believe it can only be achieved through a widening of the tax base. The question that has divided the economic experts though is: can the government mobilize revenues without new taxes, while proposing to reduce the exports’ tax regime, increasing/giving new exemptions esp. to SEZs. So from power sector to agriculture, there’s something for all; tax cuts; subsidies, exemptions.

And how would the govt keep inflation under control when it intends to spend too much to achieve the targeted economic growth? In other words, the fiscal and trade deficits will increase further unless the tax and non-tax revenue targets are met and the exports are increased to $30 bn, according to Razzak Dawood. For sustainable economic growth, exports should make up to 20 pc of GDP, according to Tareen.

Since the government’s revenue and resource endowments remain unable to meet the country’s expenditures – which have risen by 15% to Rs 8.49 trillion in the financial year (FY) 2021-22 – it is attempting to fulfill the tidy outlay target of 4.8pc growth through (over) spending on public sector development ($900 billion). This demand driven growth will accompany inflation. So, will history be repeating itself or will the government realize how hard the task is, and thus decide to revamp or renew its ways?

Effect on Investment

Secondly, excessive government borrowing from local banks will crowd out private investment which has been largely ignored in the budget. Now, as well as in the past.

It is worth noting that the government is seeking job creation through its own social spending schemes – like Kamyab Jawaan Programme etc. Our investment to GDP ratio is one of the lowest in the region and investment, especially local-driven, is crucial for employment and thus economic growth.

Experts are of the opinion that Pakistan needs a growth rate of 6-8 percent per year to achieve full scale employment of our youth. Expert Raza Rumi also lays emphasis on the significance of local investment ventures.

The government wants us all to believe that public spending furthers economic growth and job creation, this kind of spending, even if it’s reckless is good for the economy and social well-being and fuels growth. I will not debunk this line of thought altogether despite the past year’s significant spending not yielding projected outcomes. Indeed, the government spending indicates a welfare model and there are examples of positive outcomes with that model. For instance the state came to the rescue through spending during the Great Depression of the 1930s, post World War 2 era and through the Marshall Plan when the US gave direct funding to European states for rebuilding and growing economically. Interestingly, aid was also given to third world countries like Pakistan – but they grew dependent on foreign aid.

Government spending-based growth

It is possible that increased spending and rise in tax could lead to an increase in GDP through a multiplier effect. If government spending causes the unemployed to gain jobs, they will have more income to spend, leading to a further increase in aggregate demand. However, with mostly social spending the government would run into fiscal and trade deficits and incur more loans if it did not adopt alternative revenue generation strategies.

Interventionist budget

What makes FY 2021-22 Budget of Pakistan distinct is that we have hardly seen anything comparable in the country’s recent history in terms of both width and coverage of people, and the depth of interventions. For instance, Musharraf era policies were based solely on growth and the ‘trickle down’ paradigm, PPP’s, and even PTI’s formerly presented budget all lag behind the current budget. Also, as looked at from the regional lens, one finds it “people-centric”, bottom-up, and “inclusive” growth, based on the principle of “sustainable” economic growth that targets the most vulnerable directly; without waiting on the growth effects to trickle down.

According to this humble author, this interventionist approach is perhaps the most needed and much appreciable roadmap for the future outlook of a state to become a welfare state with its citizens not paranoid or preoccupied with security.

This new budget is hence aimed at lending, supporting and thus lifting up impoverished groups and communities, including from the minority groups, out of their dual poverty-debt traps and other such vicious circles. This way, thereby, giving new life and hope and dreams to not just residents but overseas Pakistanis.

The main and highly advantageous key priority is to formalize the economy that has so far remained the biggest hurdle. It’s hard to track and document business activity so we never know what our actual capacity is or what has been our GDP.

I would highlight two key facts and findings which seem to have been key consideration for the incumbent government.

Trickle Down Effect -- Pakistan cannot wait

Free markets can work well and trickle down effect follows which can help achieve full scale employment and thus drive growth through job creation

But as stated by Shaukat Tareen, we – a country like Pakistan – need unabated economic growth for straight twenty years for trickle down effect to actualize. Not without some kind, or form of state intervention – direct through cash or indirect through food, clothing, shelter, housing, as being done by PTI government – note that recently World Bank also acknowledged the Pakistani government’s Ehsaas Programme as being among top of the world.

It is regrettable what had got deeply entrenched in Pakistan’s policy circles and business community during Ayub’s era – making of rich folks (remember 22 families) far more richer and believing that with time that money would eventually trickle down. Recall the Washington Consensus which later on down the years also endorsed this narrative of free market capitalism.

Pro-poor Budget

The pro-poor initiatives and social safety nets include the Ehsaas Programme’s “expansion” (Rs260bn). Further, no more taxes for salaried classes and 10 percent increase in salaries and pensions of government employees (which in a way sets the increment level in private sector). What it entails is that due to cut in taxes, or/and ‘increasing’ incomes – people will have more disposable incomes to spend – especially the poor/middle class – so such social spending schemes will greatly benefit the poor. Those impoverished could come out of poverty.

What is left after spending would be saved (or invested). So there could be two impacts: 1.Demand-push inflation caused by increased buying in the short term. And, 2. Increase in savings for both govt and private employees who have their wages increased.

Interestingly, the income could be brought under taxation if the govt adopts a carefully crafted strategy. Yes, the govt could still ‘receive’ tax money from disposable incomes through sale receipt system. One way to increase taxes as suggested by Tareen is a prize scheme to increase tax base. Thus, prizes amounting to Rs250 million will be distributed among receipt holders every month; a move that would help in documentation of the economy and add about 312,000 potential taxpayers. The government expects to collect Rs100 to Rs150 bn additional revenue through the PoS system (as Points of Sale will be increased from 10,000 to 60,000).

Revenues and tax widening go together

Tax collection target set at Rs5,829bn is both highly challenging and aggressive; experts believe it can only be achieved through a widening of the tax base. The question that has divided the economic experts though is: can the government mobilize revenues without new taxes, while proposing to reduce the exports’ tax regime, increasing/giving new exemptions esp. to SEZs. So from power sector to agriculture, there’s something for all; tax cuts; subsidies, exemptions.

And how would the govt keep inflation under control when it intends to spend too much to achieve the targeted economic growth? In other words, the fiscal and trade deficits will increase further unless the tax and non-tax revenue targets are met and the exports are increased to $30 bn, according to Razzak Dawood. For sustainable economic growth, exports should make up to 20 pc of GDP, according to Tareen.